Ask any person if they are ready for retirement and the answer is probably going to be “Yes”. This is especially true if you are dissatisfied with your current employment. The truth of the matter is that should the planning for a financial retirement been delayed or started late now is the time to take action.

Ask any person if they are ready for retirement and the answer is probably going to be “Yes”. This is especially true if you are dissatisfied with your current employment. The truth of the matter is that should the planning for a financial retirement been delayed or started late now is the time to take action.

When Should Retirement Planning Begin

Retirement planning should begin as soon as a person starts earning an income. It is not hard to put 10% of your income away each month. The sooner a person starts the easier it is to make your retirement decisions. I find that getting that message across to young people is hard as the shiny objects of the world will be in competition for their money and playing catch-up when you are old is tough, but can be done.

Retirement planning should begin as soon as a person starts earning an income. It is not hard to put 10% of your income away each month. The sooner a person starts the easier it is to make your retirement decisions. I find that getting that message across to young people is hard as the shiny objects of the world will be in competition for their money and playing catch-up when you are old is tough, but can be done.

The Plan

The journey to retirement begins with living within our means. Over spending and big ticket items leads to big debt loads. Living with in our means living within the boundary of our paychecks. The next part of the plan is to start saving. If you have a company retirement plan it is in your best interest to put in the maximum amount possible.

Should your place of employment not have a retirement plan you must manage your own savings program. A minimum amount to put away every month should be 10% percent of your paycheck. A financial adviser should be consulted so you can maximize your return on savings. Self administered retirement plans are not impossible, however these require study and careful planning. Be careful with your hard-earned money.

Supplement Your Income

Supplementing your income should be something that is easy and something to look forward to. A second job could be an answer, however it could conceivably cut into family time or other things that would not necessarily be enjoyable.

I think the income supplement should be able to produce significant income, be manageable from home or anywhere else there is an internet connection.

The concept I am going to present to you is an Internet solution that when approached with the dedication required could allow you to leave your job and retire when you are ready.

Retiring with enough money and resources allows you plan your own future and make your own decisions. The answer is Wealthy Affiliate.

Wealthy Affiliate

Wealth Affiliate is an educational platform that will train you to build an Internet based business that you can work at your own time and convenience. It has to be mentioned at this time that this project requires considerable dedication. You will have to develop a goal and a time line. Recent students have produced considerable income within a year of enrollment. This does not happen without the necessary effort being applied.

Wealthy Affiliate is an income solution for the high school student, the stay-at-home mom or dad, someone needing a second job, the retired person needing an income supplement. As I write this I am working from my home office, I am my own supervisor and my cat steps on the key board. I am available to tend to anything at home and there is no commuting.

Wealthy Affiliate is a one stop shop where a student can take advantage of World Class training, website building and hosting, 24/7 tech support and research tools. Please follow this link to my Wealthy Affiliate – The Key To Your Financial Freedom for more information.

Wealthy Affiliate is affordable and is worth the $359.00/Year USD. There are no up sells and what you see is what you get. There are some incidental costs such as domains which is part of doing business. Some software upgrades for the SEO tools and themes are not necessary but can be purchased at your discretion.

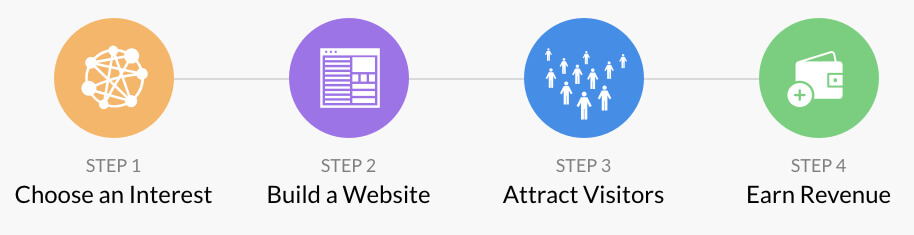

Wealth Affiliate works by applying these four concepts. Follow the training and build your future. In a recent motivational video the narrator stated that 70% of people are dissatisfied with their jobs. If this is you Wealthy Affiliate can be your solution. Follow this link to my previous post “There Is No Plan B” to view the video.

In Closing

Retirement can be stressful when you are under financed. Preparing for the end of your working days is best started as early as possible. If you can manage your life to have as little debt as possible that is a good start. If you are in debt please read my post on Personal Debt Reduction. Learn to save, participate in a pension plan.

I must emphasize that without the required effort a person cannot expect big results. It is also necessary to balance your work life and enjoy the time you have. Constant work without experiencing LIFE is tedious, but retiring without proper financing is no fun either.

I must emphasize that without the required effort a person cannot expect big results. It is also necessary to balance your work life and enjoy the time you have. Constant work without experiencing LIFE is tedious, but retiring without proper financing is no fun either.

Everyone is given the same 24 hours a day. Some people waste it, some people make a difference.

That’s my story for today. Please leave a comment, question or criticism below. I look forward to your thoughts.

Trevor

In compliance with the FTC guidelines, please assume the following about links and posts on this site: Any/all of the links wealthycitizen.com are affiliate links of which I receive a small compensation from sales of certain items. Please click this link for the full Affiliate Disclosure